How to Avoid These Surprising Mistakes That Cost Me $145,000

Jun 11, 2024

Looking at you 20 somethings!

I’m baring it all in this one!

Why am I spilling the tea about my biggest financial blunders?

For starters, I wan’t you to AVOID these mistakes if all possible. If you’re in your 20’s, pay attention. These 3 mistakes alone cost me over $145,000 — not including compound interest!

I also hope to help you realize that everyone makes financial mistakes, big and small. Like everyone who has lived. Not one person has had at least a little money regret. So, whether you’ve made the same mistakes as me or other mistakes, know that you’re not alone.

My Most Expensive Mistakes

- Not signing a prenuptial agreement.

- Moving my old 401k to a new employer’s 401k.

- Contributing less than the maximum 401k contributions.

Not signing a prenuptial agreement

I don’t know how many times during the 18 months of divorce proceedings my lawyer said:

“You know you could have avoided all this if you had a prenup.”

Thanks. There’s a few things he was alluding to when he said this. Without going into the gory details here’s a little recap.

Due to addiction and illness my ex-husband had a difficult time keeping a job and saving money. Because of a hospital stay while we were separated, his net worth went into the negative. However, I had become intentional about saving and investing and had a solid net worth of approximately $100,000. Originally, his attorney asked for a settlement of $50,000. After months of negotiation, I walk away with a settlement of about $35,000. Still A LOT of money!

This doesn't include my lawyer’s fees of $6,000. Note that my lawyer’s fees would have been 3x as much if I hadn't purchased legal insurance. If you have this option through your employer- I recommend it. It costs about $25 a month and saved me $12,000 — so that move was not a mistake!

Here’s what I would have saved if I had insisted on a prenup- even though my net worth was only $40k at the time: $35,000, 6 months in litigation and emotional distress.

The divorce rate for 2021 is 45%.

If you’re in a serious relationship & looking to get married, I recommend getting a prenuptial agreement. If anything, at least talk to an attorney about the divorce laws for your state. A marriage is the biggest contract you’ll ever enter into. Why not do your due diligence, protect yourself and go into it confidently! Plus, what better way to decide details around an amicable break when you are happy and in love?

Moving my old 401k to a new employer’s 401k

At first glance, this didn't seem like a mistake.

I got a new job and wanted to consolidate my old 401k into my new 401k… what’s the big deal, right?

Well, as the rollover process proceeded, I realized one fatal flaw. Because my new 401k didn't have the exact same investment options as my old 401k, my investment portfolio had to be liquidated first.

Ok, so they would sell them at X price and I would pick up something similar in my new 401k plan at X price a week later. Except…

Prices were actually very volatile at the time and when I looked back at the prices that my portfolio sold at, I was sad. They liquidated the account at a really low time in the market.

Had a waited a month, I would have saved about $10,000 on my old employer’s company stock alone.

If I had a do-over, here’s what I would have done.

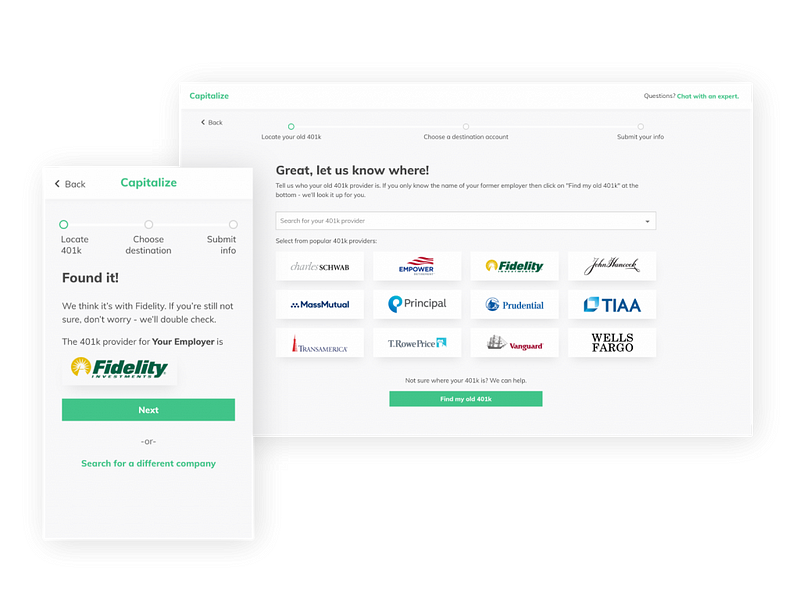

I would have rolled over my entire old 401k portfolio into a Rollover IRA at Fidelity, keeping my investment options. To make this process a piece of cake, I would have used Capitalize.

Capitalize is an independent platform that helps you find and roll over an old 401(k) into an IRA of your choice — for free! Thier rollover experts handle the process from start-to-finish, including calling the 401(k) provider on your behalf, completing paperwork, and sending faxes. Pretty cool, right?

The benefits of transferring an old 401k to an IRA :

- It’s easy to manage. An IRA gives you a place to consolidate your retirement savings every time you change jobs.

- You control your money, not your old employer. Your 401(k) is managed by your employer, which means you can lose the ability to contribute when you leave your job, and it could even be transferred without your consent. Rolling your old 401(k) funds into an IRA ensures that you control where and how you invest your savings, not your former employer.

- Get more investment options. Your 401(k) investment options are usually limited by your employer, so you can unlock more choices with an IRA, including alternative investments like real estate and crypto.

- Save with confidence. 73% of Americans don’t know what 401(k) fees they’re paying, but not knowing how your money is invested or what fees you’re paying could cost you a lot. IRAs provide easy visibility into fees, so you can choose an account that makes sense for you.

Oh, hindsight is 20/20!

Contributing less than the maximum 401k contributions

Looking back, I could have invested more in my 20's.

Here’s why I didn't.

-

Everyone said it was cool if you could just ‘contribute up to the match.’

OK, maybe you’ve heard this too — just make sure you get your ‘free money.’ One- that money isn't really free- it’s part of your compensation package. Two- this advice usually comes with a caveat that you’re also contributing to a Roth IRA too. Oops! I missed that part in my 20's! -

I thought I needed the money!

There were far more exciting items I wanted to spend money on. Drinks with friends, concerts, vacation, take out, a new outfit every weekend. If I was being intentional with my money, I would have been able to spare an extra $100 a month. That’s an extra (cough) $108k at age 50. Dang.

-

I didn’t know much about compound interest.

Strange as it sounds, I wasn't always fascinated by financial literacy content. Although I attended a variety of math, accounting and business classes- I don’t remember a compound interest conversation. This is a major miss for high school and college classes. Why we’re not taking the time to show students how to become millionaires is beyond me.

Financial mistakes happen

Here’s the good and bad of it. The bad news: There’s no avoiding it. I’ve never met someone who hasn't made at least one little error.

The good news: You have the opportunity to learn from these mistakes- so take it! Then, move on. Like really move on. Don’t dwell, don’t linger, don’t beat yourself up. Take your lessons and keep going. You got this!

Ready to get to the next level of financial success? Learn more about my signature 1:1 Holistic Financial Coaching program [HERE] and let's transform your financial life and accomplish your #moneygoals 4x faster than the DIY method!