7 Ways to Stay Financially Prepared

Aug 18, 2021

My answer to a dinner party question

I’ll set the scene. Here I am at one of my first post (ish)- covid girls dinner party. I think it was a French theme, put on by my friend Liz. While chatting away, I mention that I work as a finance coach. As per usual, this drums up some conversation and questions. This evening a new question popped up: ‘But Genevieve, how do I stay prepared? The future gives me anxiety and I find it hard to prepare for things I don’t know are coming.’

Solid question. A whole blog-worthy question.

So, here’s the deal. I don’t have a crystal ball and even the expert psychics in New Orleans can’t tell you exactly what financial obstacles and opportunities will be available in the future.

The question becomes, how do we prepare for the unknown? Will I snag that 7-figure job? Will my parents need my help? Will I finally buy that farm to house all the dogs I want to rescue? Will I be able to take a 6-month tour of the world? So many questions and very few answers. It’s said that living in the future gives you anxiety and I agree. That’s why my strategy is all around covering the basics and providing flexibility for the future. This is something I recommend to clients too. The following summarizes steps that you can take to feel financially secure — no matter what the world throws your way.

7 Ways to be financially secure

- Have enough cash on hand for emergencies.

- Start with your goals now because- newsflash- you can always tweak them later.

- Focus on your health. If 2020 taught us anything, it’s that being healthy = being wealthy.

- Insure your physical assets. Take it from a lady who’s lived in 3 hurricane strike zones- stuff happens when you least expect it.

- Insure your non-physical assets. If you’re investing, how can you create a safety net?

- Have more than one income stream. If you’ve lost a job, you’ll understand. If you haven't, learn from those who have.

- Have access to funds. Yes, I mean credit.

Let’s dive into these items and figure out how we can ditch the anxiety around money and start living for today.

Have enough cash on hand for emergencies.

Truly this is the #1 rule of personal finance. According to a recent Bankrate survey, 51% of Americans have less than 3 month’s worth of expenses saved and 25% of Americans have ZERO saved for emergencies.

Notice that I said ‘enough’ cash. No need to be Scrooge McDuck swimming in cash, but also not an arbitrary amount like $1000 (looking at you Dave).

I talk a little about how much you need in this post, but if you have a steady job and 3 months worth of expenses would also cover any insurance deductibles- this may be right for you.

Look, I get it. Talking about emergency funds is not sexy personal finance material. Compound interest calculators get way more ‘likes & shares.’ Emergency funds are foundational. If you’ve been adulting for any period of time you know that the A/C breaks, your car needs new tires, and your dog eats something that costs $2000. It’s not ‘if’ something happens, but ‘when.’

Not having enough cash on hand comes with many consequences: going into debt, paying interest, delayed investments and most of all TIME that you’ll waste ‘catching up’ instead of ‘moving on’ from said emergency.

Start with your goals now because- newsflash- you can always tweak them later.

Sometimes starting with the end in mind can help you get started. Knowing when you want to be work optional, what kind of vacation you want to take, or where you want to buy your first home can help you come up with a long-term plan.

For example: In 25 years Eboni wants to have the option to stop working and live off of $40,000 each year - she’ll need $1 million invested (using the 4% rule). This means with a 7.5% average rate of return, she’ll target to invest about $1,130 each month.

You can find my favorite investment calculator & more resources HERE.

Don’t let the thought of planning 10, 20 or 30 years down the line bog you down. You can always tweak your plan. In fact, I’d prefer it if you did. Your values will change over time and that’s good- it’s a sign of growth. So check in with yourself every year.

With that being said, having an end goal in mind will help you to take proactive action & stay motivated- keeping you prepared if your plan works out perfectly… or not!

Focus on your health. If 2020 taught us anything it’s that being healthy = being wealthy.

Currently healthcare accounts for 8–10% of a retiree’s budget. As you can imagine, these costs will continue to increase over time. So, what’s the biggest way to reduce these future costs?

Preventative care. According to The Balance, preventive care helps lower health care costs in America by preventing or treating diseases before they require emergency room care.

Regular exercise, a healthy diet, regular check ups and routine screenings can decrease the need for any hospital visits. The average hospital or emergency room visit is $1,200. Having appropriate insurance coverage and taking advantage of preventive services are key- so don’t sleep on those annual doctor visits.

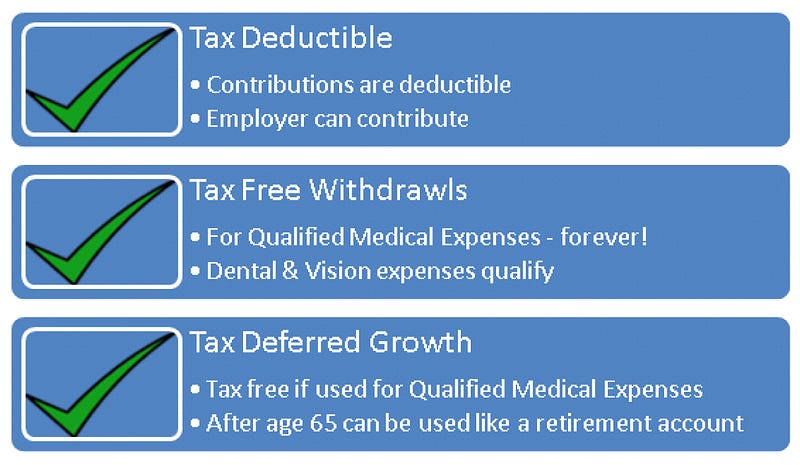

In addition, you may want to look into a Health Savings Account (HSA) if you have an eligible high deductible plan. HSA’s have 3 different tax benefits and can help you stay prepared for unforeseen medical emergencies.

Lastly, please get life insurance & don’t put off estate planning. If you have anyone who is in any way dependant on you- this is IMPORTANT. The last thing you want your love ones to go through while grieving is dealing with a messy estate situation just because you forgot to make that lawyers appointment or didn't feel like paying $100 for a will.

Insure your physical assets. Take it from a lady whose lived in 3 hurricane strike zones- stuff happens when you least expect it.

After living all of my life in Florida, South Carolina & Louisiana- I’ve got hurricane prep down to a science. With that being said, I cannot stress how important it is to insure your physical assets.

Thanks to global warming, natural disasters won’t be slowing down anytime soon. Having proper levels of auto, home, property insurance can help keep you covered, save you thousands and give you peace of mind as the seasons pass.

Keep in mind, we have to combine this with tip #1. Last year when Hurricane Zeta took off the roof and blew the fence down at our rental property- we paid out a $7,500 insurance deductible. Thankfully, we had that in an emergency fund. But if we didn't, we’d have to borrow, pay interest and waste time paying that back instead of moving forward with our long term goals.

Just like your goals, insurance needs & prices change often. Check in yearly to switch policies and save each year.

Go ahead, take a moment to set a calendar reminder before reading on!

Insure your non- physical assets. If you’re investing, how can you create a safety net?

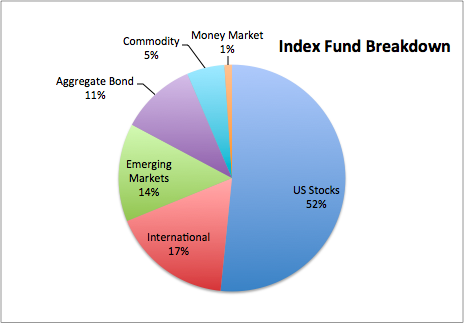

This is all about having the right asset allocation and diversifying your portfolio- in other words not putting all your eggs in one basket. Having the right asset allocation is all about finding the right mix of assets. Typically this includes stocks, bonds & cash- but you could also throw in Crypto, Art & Real Estate. Everyone’s asset allocation will be different, but typically investing all of your money in only one asset class will put you in a compromising position.

Diversification is more about what you hold within each asset class. For example, if 50% of your money is in the stock market- what sectors of the market are you invested in? Do you have a lot of tech, finances or retail? Are you holding mostly large companies or small ones? Are the companies local or international?

Having a solid mix will help even out your returns. As one sector decreases, you’ll likely be invested in another sector that’s increasing!

This is not financial advice, but below is an example of my portfolio mix:

Have more than one income stream. If you’ve lost a job you’ll understand. If you haven’t, learn from those who have.

I will never forget the day that my boss sat me down with coffee and let me know that due to financial crisis (this was 2008) that I’d be let go and he’d need my laptop and my car. Yes, I went home in a taxi. Anyways, it was a big wake up call that having just a salary to rely on is a recipe for high anxiety.

Besides helping you get to your financial goals faster, having multiple streams of income can provide us with a huge sense of security. Rumor has it that most millionaires have 7 different income streams. Take a look and see which ones you have checked off your list:

- Earned Income- This is working income (also taxed the highest!)

- Profit Income- This is income earned from a business

- Interest Income- This is income earned from bonds or lending money to other people.

- Dividend Income- This is income earned from stocks that pay out dividends.

- Rental Income- This is income coming from rental property you own.

- Capital Gains Income- This is income earned from the sale of assets that have appreciated in value.

- Royalty Income- This is income earned from creating a product and charging others to use it over and over.

Not saying you have to check every single box, but if you’re working a 9–5 and investing within your 401k, you’ve likely got 3 already (earned, dividend & capital gains)- look at you go!

Read up on more reasons to invest HERE, and take a look at the final piece where TAXES come into play!

Have access to funds. Yes, I mean credit.

OK, this one is a bit controversial, but I tend to reject the ‘one size fits all’ financial ‘gurus’ who say all debt is bad and credit scores don’t matter (you know who you are).

The fact is, over years in finance I have seen so many people in NEED of credit, only to find it’s too late. The job has been lost, a payment has gone late and their score has gone down. Apply for credit while things are good. Please.

Have a line of credit for emergencies, it’ll be your last line of defense, but if it comes to that, you’ll be happy you had it.

Don’t let a lack of preparation rob you of your financial peace. Speaking of peace, your money mindset plays a big role in staying prepared too.

Worry gets you NOWHERE.

I know, because I’ve been there. I’ve had more sleepless nights than I can remember crunching numbers in my head, trying to figure out if I had enough money for the next 6 months or 6 years. Running through every ‘what if’ scenario in my mind.

The truth is, we can’t control the future- so why live there? One of the best things we can do to feel prepared is to focus on the present. What actions are we taking today to help us in the future? What can we be grateful for today? In what ways can we see the abundance of this world & realize that we will always have enough?

Focus on the present, have a little trust and in the words of Bob Marley, ‘Everything is gonna be alright.’