Why I Think You Should Ditch Your Budget

May 05, 2021

And simplify the way your spend.

You’ve heard it before… 'you have to track your spending, you have to budget!' People make thousands of dollars selling fancy budget trackers and excel sheets so that you can track Every. Single. Dollar. Every. Single. Month.

But when does it end? Does it ever stop? Will there ever be a day when you’re not budgeting? Is there another way?

Let’s find out together!

'Having a budget' vs. 'budgeting'

In my opinion ‘budget’ is a bit of a 4 letter word, but there’s a reason budgeting was probably the first piece of personal finance advice you received.

There is a big misconception that a budget is a worksheet or app, but in reality the act of budgeting is not one piece of paper, but a 3- part process:

- Know what money is coming in.

- Plan out where the money goes or how it will be spent.

- Review your accounts at the end of time period to see whether or not you spent within your plan.

The benefits of budgeting

The reason that many financial experts claim that you have to start with a budget is because it does provide major benefits. Here’s why you might want a budget:

- You will see EXACTLY where you’re money is going. For example instead of saying ‘I spend about $100 each month going out to eat’ you can say ‘Last month, I know I spent $145 going out to eat.’ Do you see the difference? It’s confidence.

- You’ll be more motivated to get organized. I’ve met so many people who have way to many accounts and credit cards and it makes it really hard, but also a really good excuse, to not track their spending and ‘accidently’ spend more than they thought- month after month. Is this you?

- You can easily create a strategy for whatever your goals are. How can you allocate 20% of your disposable income to *insert financial goal here* if you don’t know how much disposable income you have? Needless to say having a budget will give you the clarity you need to make SMART goals and help you stick to them.

- You’ll be more likely to talk about money. When’s the last time you talked about money with your spouse/child/partner/best friend/ parent? If it’s been awhile, you’re not alone. 51% of Americans don’t feel comfortable talking about money (you can read more here). However, the more you feel clear and knowledgeable about your own finances, you’ll have more confidence to breach the subject. Financial literacy happens through conversations, so this helps you and the folks around you!

Budgeting options

There are too many budgeting options to review here- so I’ll hit the high points of the most common budgeting systems and do a deeper dive another day:

- Line item: This is where you list out exactly where your money is going and break it up into categories of your choosing.

- 50%/30%/20%: In this budget you take your total income and break it up into needs, wants, and other financial goals like saving or paying down debt. You can also tweak these percentages as you’d like.

- Pay yourself first: This method keeps it a little more simplified with prioritizing just your savings. For example, no matter what $500 each month is going towards your retirement, paying down debt and emergency fund. You’re not really concerned about where the remainder of your funds go.

- Envelope or cash system: This budget was made popular by Dave Ramsey back in the day. When you get paid, you’ll take the money out in cash and separate it into different envelopes for different purposes to use accordingly until your next payday.

- Zero-based budget: In this system the point is to give each dollar you take home a job. You’ll start with your take home income and allocate each dollar as specifically as possible.

The down-side of the budget

So, why am I hating on budgets a little bit?

Despite the benefits listed above only 41% of Americans use a budget. So, as much as I love all of the benefits and know that getting clarity around your finances is the most crucial step to making money moves- turns out there are some downsides to the traditional budgeting methods.

Why I think you should ditch your budget

- Takes too much time and effort.

- Too rigid, lack of flexibility.

- Getting too deep in the weeds & losing sight of the big picture.

- Encourages a negative connotation around spending.

- Too much focus on your bills and expenses first.

- A pass/fail attitude.

Let’s take a deeper look at these and how they can affect your money mindset.

Takes too much time and effort.

Ok, this is a given, right? If you relate to this budget pain point, you’re not alone. 36% of Americans agree that budgeting is just too much work. Here’s my take.

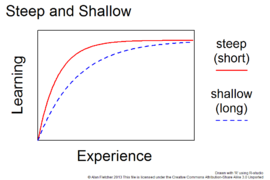

I’m not mad at a budgeting being laborious up front. Anytime you’re looking to make changes in your life- be it starting a new fitness routine, learning a new language, or starting a new hobby like gardening- there will be a learning curve. Check out the graph below. When we start the journey of learning we require a lot of experience (meaning time) up front. Eventually, we plateau. So it makes sense that budgeting will be work upfront. You will most likely need your favorite cup of coffee and a full morning to identify your purchases, your spending habits, your income and your net worth.

After this though, budgeting should get easier and less lengthy — but it doesn't for most.

Too rigid, lack of flexibility.

Have you ever had 2 months where your spending habits were exactly the same? Yea, me either. This is one of the problems with traditional budgeting systems- they are based on projections of previous months spend. Currently, this might become more of a challenge as our lives evolve in a post-pandemic world, where upcoming concerts and events can add expenses to our entertainment line items that we haven't had to deal with in over a year.

Getting too deep in the weeds & losing sight of the big picture.

Have you ever been watching YouTube, look up, and realize that it’s been over an hour?

Spreadsheets can have a similar effect as you try to figure out a million different ways to ‘fit’ every little detail in your budgeting plan. You can easily spend hours analysing every penny with little to zero results.

Although I like an exercise of analyzing your spending in how it relates to your happiness (keep reading to learn more), it shouldn't be something that goes on for eternity.

Your time would be better spent thinking about the BIG picture. Most people’s 3 biggest expenses are their mortgage or rent, taxes, and a car payment or other debt payment.

So instead of analyzing every single thing you buy each month until the end of time, just once ask yourself:

- Could I change anything about my living situation that would lower my costs and not affect my wellbeing? Some examples might be: move in with family, refinance your mortgage, house hack, move to a different neighborhood or smaller apartment.

- How can I lower my taxable income? This could include investing more in your 401k or traditional IRA, making donations, investing in real estate, talking to a CPA.

- How can I pay down my debt faster? Some options here are consolidating student loans, calling the credit card companies for a lower rate, trading in a car to lower or get rid of your car payment.

Encourages a negative connotation around spending.

Spending is not all bad. Repeat it with me: Spending is not all bad. Budgeting can force us to blame spending for our less than perfect financial situation. This can leave you feeling guilty about spending or even going on spending freezes and binges habitually. All, which is not a part of financial wellness. Remember, the thoughts about your reality create your actions which create your results.

Narrows the focus on your bills and expenses first.

I’m sure you’ve heard the term ‘budget cut,’ but when’s the last time you’ve heard of a budget expansion? This is a huge traditional budgeting trap! Ramit Sethi said it best in his book I Will Teach You to be Rich. There is a limit to how much you can cut, but there is no limit to how much you can earn. Traditional budgeting methods narrow your focus down to how many expenses you can cut rather than how much you can earn. Why is this a problem?

Because cutting expenses and being ultra frugal does not equal building wealth.

If that’s not enough, adopting a ‘bills first’ mentality can really mess up your money mindset. I ask clients all the time what they would do with an extra $5,000? Most of the time they say something along the lines of ‘pay bills, maybe invest.’ Really? That’s it?!

Not that paying bills or investing is bad, but it’s also not particularly putting yourself first. Blowing the entire $5k might be self sabotage, but not even a night on the town, donating to charity or a massage have come up. And if you don’t believe you should put yourself first for the small things (or even a hypothetical situation), you’ll have a hard time doing just that with the big stuff. Of all the traditional budgeting methods, I do like the ‘pay yourself first’ method for this reason.

A pass/fail attitude.

Tell me if this sounds familiar: Your reviewing the new budget you laid out for yourself and comparing your month’s spending to the plan. You realize you’ve gone over and say to yourself any number of these things:

‘Well, that’s it. I quit. This is dumb. Clearly I can’t do this. I’ve failed at my budget. I must be bad with money. What’s the point of trying.’

This can happen easily with traditional budget methods and is problematic because it prevents you from gaining value from your budget and actually continuing it.

Now that you’ve read this far you’re probably wondering what a solution is…

A solution to traditional budgeting

The truth is, there are many solutions, but I’m going to highlight one here.

It’s called intentional spending.

What is intentional spending?

Turns out, there is much more that goes into our spending habits than we think. Behavioral economists show us that emotions and unconscious biases affect our spending in lots of invisible ways, and these unconscious biases can be developed as far back as our childhood memories.

Intentional spending is when you are actively thinking about your purchases and ensuring they align with your values.

Why might intentional spending be better than traditional budgeting?

Practicing intentional spending helps you get more ‘bang’ for your ‘bucks’ when it comes to the joy of spending. It can also lead to developing more conscious behavior & savoring of special moments — two things that are scientifically proven to increase everyday happiness! And isn't that what life’s about anyway?

How do I start spending more intentionally?

Just like ‘being healthy’ is more than a diet, ‘intentional spending’ is more than one action, and must become ingrained into your overall daily lifestyle.

The good news is, with a little practice you can get started fairly easily.

Here are a couple exercises to get you going:

- Start a gratitude list. Write down (or tell someone or put it in your phone) 3 things you are grateful for every day. No repeats. Set a reminder in your phone so you don’t forget!

- Go through every purchase you make once a week for 4 weeks. Rate each purchase a 1–5 on a scale of ‘how happy or joyful’ did this purchase really make you. 1 = ‘Not happy, I wish I didn’t make this purchase,’ 5 = ‘Super happy and joyful, I would buy again or even pay more for this.’

These exercises will help identify your values, otherwise known as the …

Want some examples of what your core values could consist of?

Check out this list from James Clear.

How does intentional spending help me spend less money?

Well, after practicing the above exercises and adopting intentional spending into your lifestyle you might find that the next time you…

- Think about going out to eat you might say ‘I THOUGHT this would make me happy, but last time I went out I actually left really full and not feeling well, I think I’ll cook at home.’

- Are shopping with friends and see some cute shoes you might think ‘I realized last time I bought new shoes they stayed in my closet for over a month, even though these are great- they won’t really add value to my closet or life.’

- Are getting ready to renew your gym membership you might say to yourself, ‘I’ve actually enjoyed exercising outside way more than the gym the last couple months- I think I can let this membership go.’

These are just examples. Maybe you are someone who really values going out to a nice dinner, having the latest fashions or making friends at the gym. The point is overall you will start to connect the dots and spend more on the things that mean most, and less on the things that don’t!

Before I let you go…

I love intentional spending, but I always recommend using it with some form of paying yourself first. Hopefully this is high on your list anyways. Make sure those auto transfers are turned on for your retirement contributions, emergency fund or sinking fund and your debt paydown strategies. Beyond these big-picture items, spend intentionally and watch yourself become more aligned with your money and financially well!

Still figuring out how to get started?

Get clear with your current financial situation, set the right goals & follow through with the workbook that I've been using for years. Yes, it's the same one that helped me pay off over $30,000 of debt and increase my net worth over $100k. You can check it out HERE!