The Only 2 Reasons You Need To Start Investing And Build Wealth

Mar 30, 2022

This #dudewithsign kind of says it all.

I talk about the importance of investing early and often to anyone who listens. This blog we’ll break it down to the 2 fundamental reasons WHY you should be investing.

What do you mean by: Investing?

Great question. Let’s define investing before we dive in. When I say investing, I’m talking about putting your money to work. Yes, this means the stock market. This investing could take place in your 401k, IRA, or in a personal brokerage account. You don’t have to be a master stock picker to do this either. You can find low cost investments that do most of the diversification for you. If you ask me- the market is the lowest risk investment option that takes the least amount of time and capital to get started. You can also automate these investments, making them easy to stick with long term.

Now, investing doesn’t have to stop there! You can invest by starting your own business or supporting someone else’s business. You can invest in bonds or gold or the crypto market. You can invest in real estate or land. You can even invest in wine- the options are endless!

For our purposes today, I’ll be referring to investing in the market. But know there are other options out there too!

Why you should consider investing

- Inflation

- Compound Interest

This is it folks! The only two reasons why you want to invest. Let’s break it down further.

Inflation

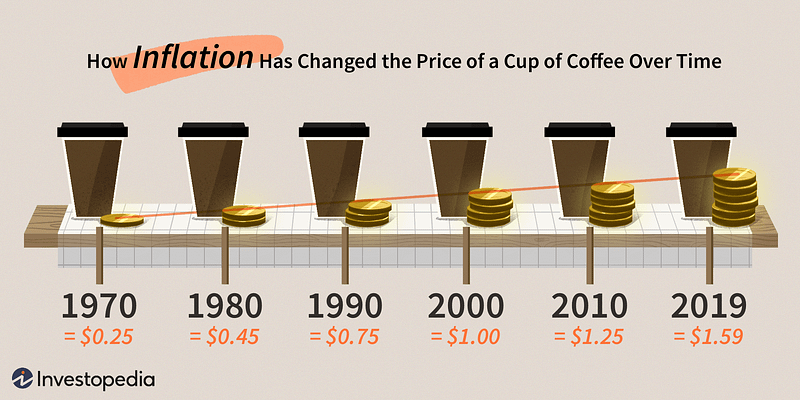

Inflation is the increase in the prices of goods and services. It’s how your grandparents refer to getting drinks for a dime…I mean really, how was it that a soda was ever $.10!

Take a look at this great graphic from Investopedia. In the past 30 years the price of a coffee has risen 53%!

So, if coffee costs can raise that much, how much do you think healthcare, food, housing and other key retirement costs will increase?

Since our needs will cost more tomorrow than they do today, this means our cash is losing value every single day- yikes. So much for hiding it under your mattress.

The Federal Reserve has long held a target of 2% annual inflation and last year was quoted saying

“We do not seek inflation that substantially exceeds 2 percent, nor do we seek inflation above 2 percent for a prolonged period.” — Jerome Powell, Federal Reserve Chair March, 2021

This might have been a premature quote. Inflation in 2021 ended up being one of the highest inflationary years in history at 7%.

Inflation happens when there is more demand for items than there is supply. After the pandemic we’re seeing supply chains disrupted due to a lack of manpower and raw materials.

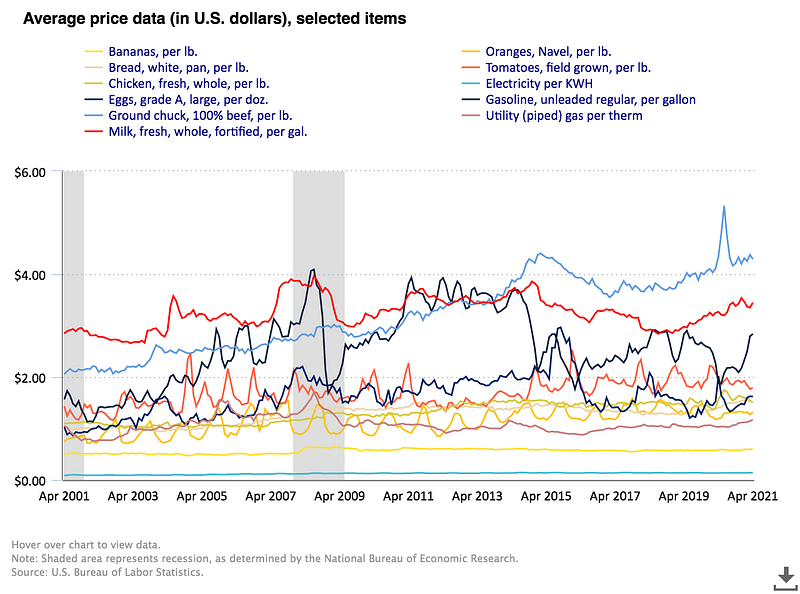

We use the CPI or consumer price index to help us measure inflation. This index measures the overall increase in price of goods and services across the company. Here’s a graph of how prices have changed over the last 20 years for a variety of goods. Looks like electricity hasn’t changed too much, especially when compared to ground beef. This report continues to change as we enter into another year of rising prices in 2022. You can break down this information even more by region on the CPI website.

Why does inflation have to do with investing?

Now that you know about inflation, the next question I hope you're asking is “how do I beat inflation?”

That’s where investing comes into play. We want to make sure that the money we’ll need in the future will grow faster than 2% each year- or 7+% this year! Luckily over 20-year periods of time the market has returned an average of 8% returns. Enough to beat inflation, secure your principal investments and build wealth.

Compound Interest

Did you know that 88% of millionaires are self made — meaning they didn’t inherit their wealth. In that study, approximately 50% of most millionaire’s income came from dividends and market appreciation.

How does investing make you money?

There are two sweet ways that investing can make you money. Investments can deliver payments back to you and they can also appreciate in value.

Payments

If you’re investing in stocks or funds that contain stocks you might receive payments back in the form of dividends. Companies can decide to issue dividends to shareholders if the company is making a profit and feels like sharing some of that profit. You can check out the ‘dividend yield’ on any stock investment to see what the annual payments might be.

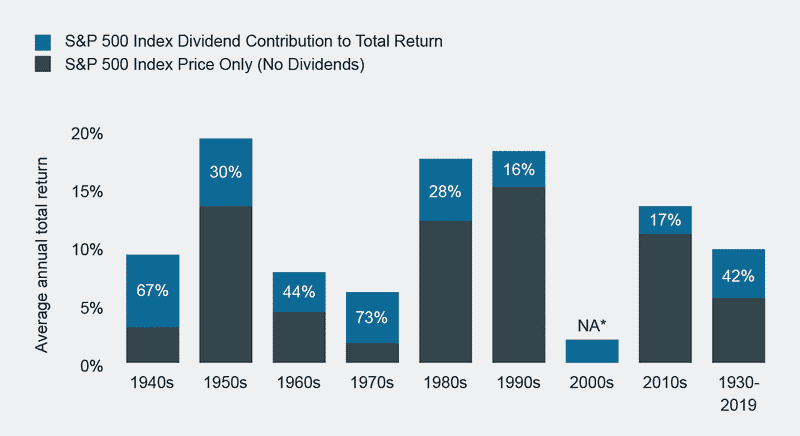

Dividends can be a powerful source of income, especially when reinvested. More about that later. But for now check out the impact of dividends on the growth of the S&P 500. For reference, this is an index that follows the 500 largest U.S. publicly traded companies, weighted by market capitalization. On average dividends contribute 42% to the fund. Not too shabby, right?

Appreciation

Appreciation is the 2nd way any investment makes you money. Appreciation is the increase in value of your investment. For the stock market, if the underlying business increases in perceived value, the price of the stock goes up.

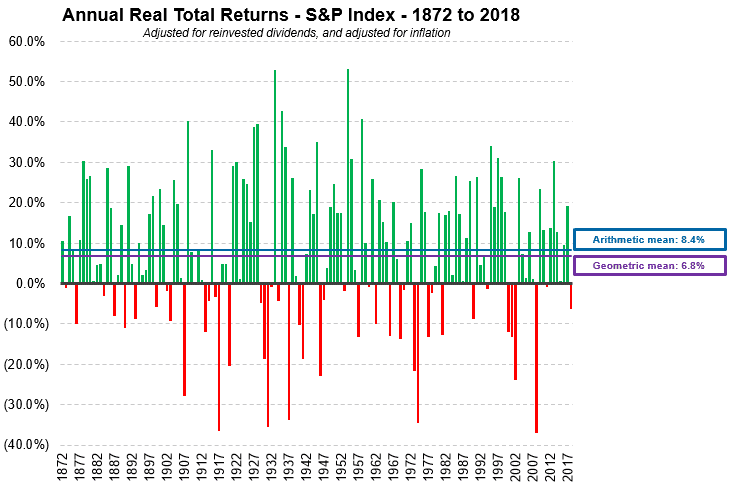

Quick warning here. The appreciation of any investment will not go in a straight line! This is why it’s so important to develop a long term strategy & mindset for any investment. You can see below that although the S&P 500 didn’t deliver returns every single year, over a 46 year time span the index returned 8.4%

Now Let’s Talk Compound Interest

Here’s where the magic happens.

Compound interest takes into account the combined effects of:

- Your original investment. This is the principal.

- Dividends or interest that your portfolio is generating. This is the income.

- Contributions, meaning more money you invest.

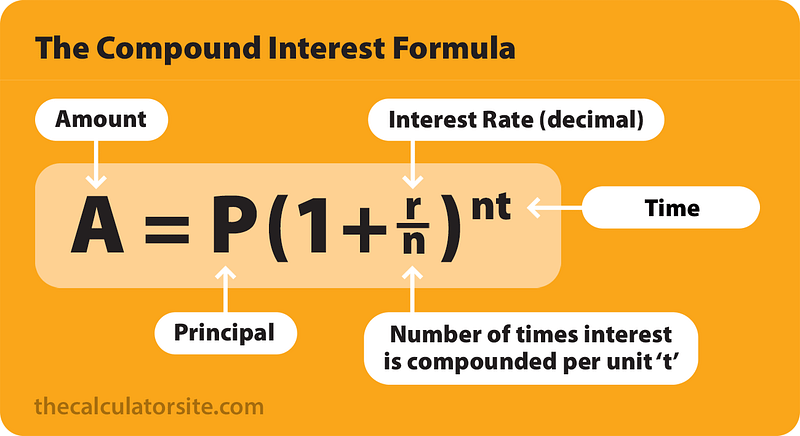

- Time. The longer you can let these ingredients mix together the better! If you’re interested- check out the exact equation below.

An example

Let’s look at a more practical example, using a 401k as an investment vehicle.

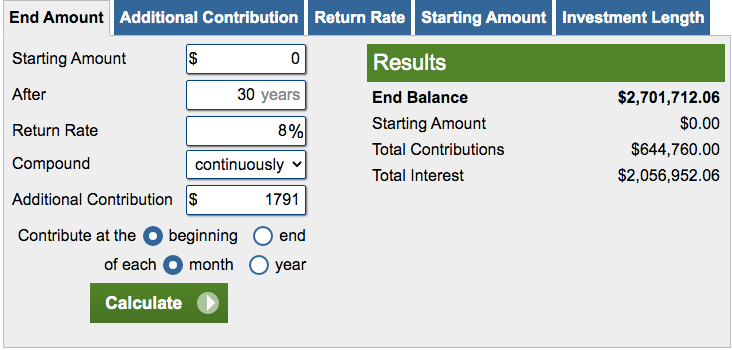

LuAnn is 26 and started a new job at an insurance company making $50,000/ year. She decides to use her 401k as her main investing account and works hard to contribute the 2021 maximum of $19,500. Her employer matches 4% of her contributions.

This leaves LuAnn with about $2,000 take home pay each month. She lives in a low cost of living area and as she receives small pay increases over time, she can upgrade her lifestyle while keeping her investing objectives the same.

In her 401k LuAnn is investing $19,500 each year and her employer will kick in another $2000 (4% of her $50k salary). So each month about $1,971 will go into her 401k. Within her 401k she’s invested in low cost index funds.

Magically, without doing too much work, at 56 LuAnn will have over $2.7 million dollars! Dang Lu! That’s more than enough to make her work optional, even with inflation.

Types of income

If learning about the dangers of inflation and the magic of compound interest hasn’t made you run to your computer- let me give you one extra reason.

Taxes.

There are 3 main types of income. Earned income, investment income and passive income. Earned income is from something like a 9–5. It typically trades time for money and is taxed on a sliding scale, you can check out the 2021 tax brackets below.

Passive income refers to real estate, or other business ventures. Most passive income takes time on the front end to set up, but then takes little time afterwards. It’s taxed in a similar way as earned income, but also allows for lots of deductions along the way!

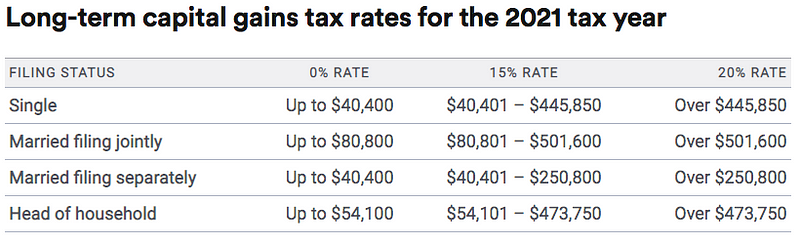

Investment income is when you sell your investment. As long as you’ve held that asset for over a year, this type of income receives preferred treatment. See the below 2021 bracket for long term capital gains for single filers.

Take a second look here.

As a single person you can make up to $40,401 of investment income (as long as you’ve held the investment for over 1 year) and pay ZERO taxes!

Meanwhile, as a single filer, $40,000 of earned income would cost you $7,812. Not to mention you’d be trading about 2,000 hours each year for this!

So that’s my final argument. The math just makes sense. If you’re able, start investing today- even if it’s $10 or $20 each week. Your future self will thank you!