8 Best Ways to Spend Your Stimulus Check

Jan 15, 2021

Months late Congress was able to pass the second stimulus package just in time for Christmas. If you’re like me, you have a million priorities on your plate and are trying to balance spending money on bills and spending on some much needed self care. Well, I have a few suggestions, that include more than just the bills. Keep reading to learn more.

What do we know about the stimulus checks?

Before we continue, let’s review a few facts about the latest stimulus passed in late december of 2020.

- If your single and made less than $75000 you should receive $600.

- If your head of household (earn < $112,000) or file jointly (earn < $150,000) you should receive $1200.

- You will receive $600 for each dependant child.

- If you earn more than the amounts listed, you may still be eligible for some money. You can also file this form with your 2020 tax return for a possible Recovery Rebate Credit.

- Your payment should be sent by January 15th. Click HERE to check on your payment status.

- There is also funding for: businesses, vaccines, climate measures, unemployment benefits, rental protections, medical bill disclosures, food security, and broadband infrastructure.

How should you spend your next stimulus check?

Hopefully, if you are eligible your check is en route! If so, here’s a list of where you should place those well-earned funds.

- Take care of your basic needs first

- Fund your emergency savings

- Get up to date on deferred bills

- Pay down high interest debt

- Support local business

- Treat yourself

- Start investing

- Give to those who need more

Yes, these are in a specific order, keep reading to check out the details.

Take care of your basic needs first

Food, rent, utilities. These are the basics. Make sure rent and utilities are up to date and utilize some of these funds to help with your job search if you are one of the thousands still unemployed.

Fund your emergency savings

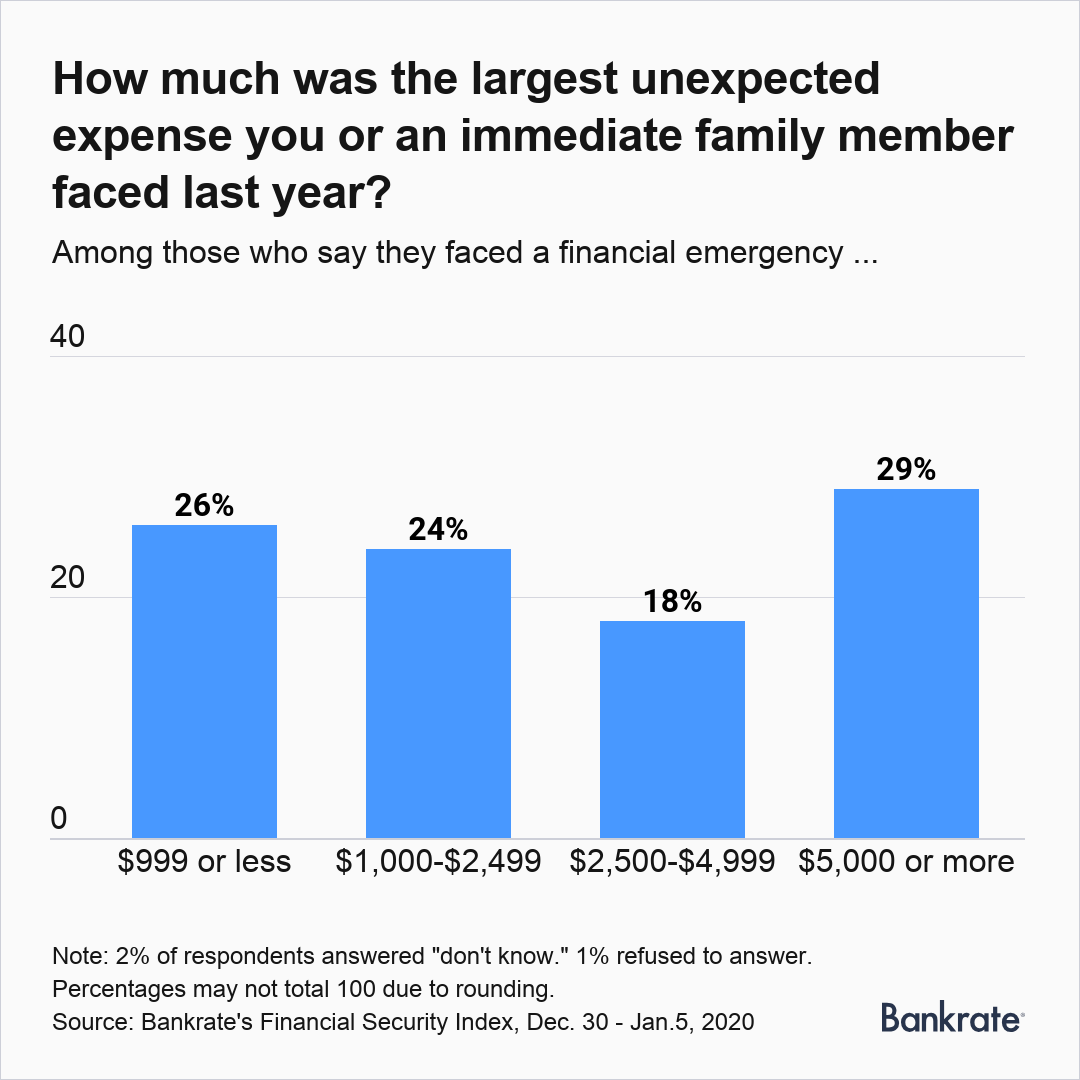

From bankrate.com

If you don’t have a basic savings account set up yet, utilize the stimulus to do this now. Although vaccine news gives us lots of hope for less Covid-related expenses in 2021, everyday emergencies are still out there. Think natural disasters (thanks climate change), car breakdowns, home repairs, medical emergencies. Make sure you have at least one-month’s worth of living expenses squirreled away.

Get up to date on deferred bills

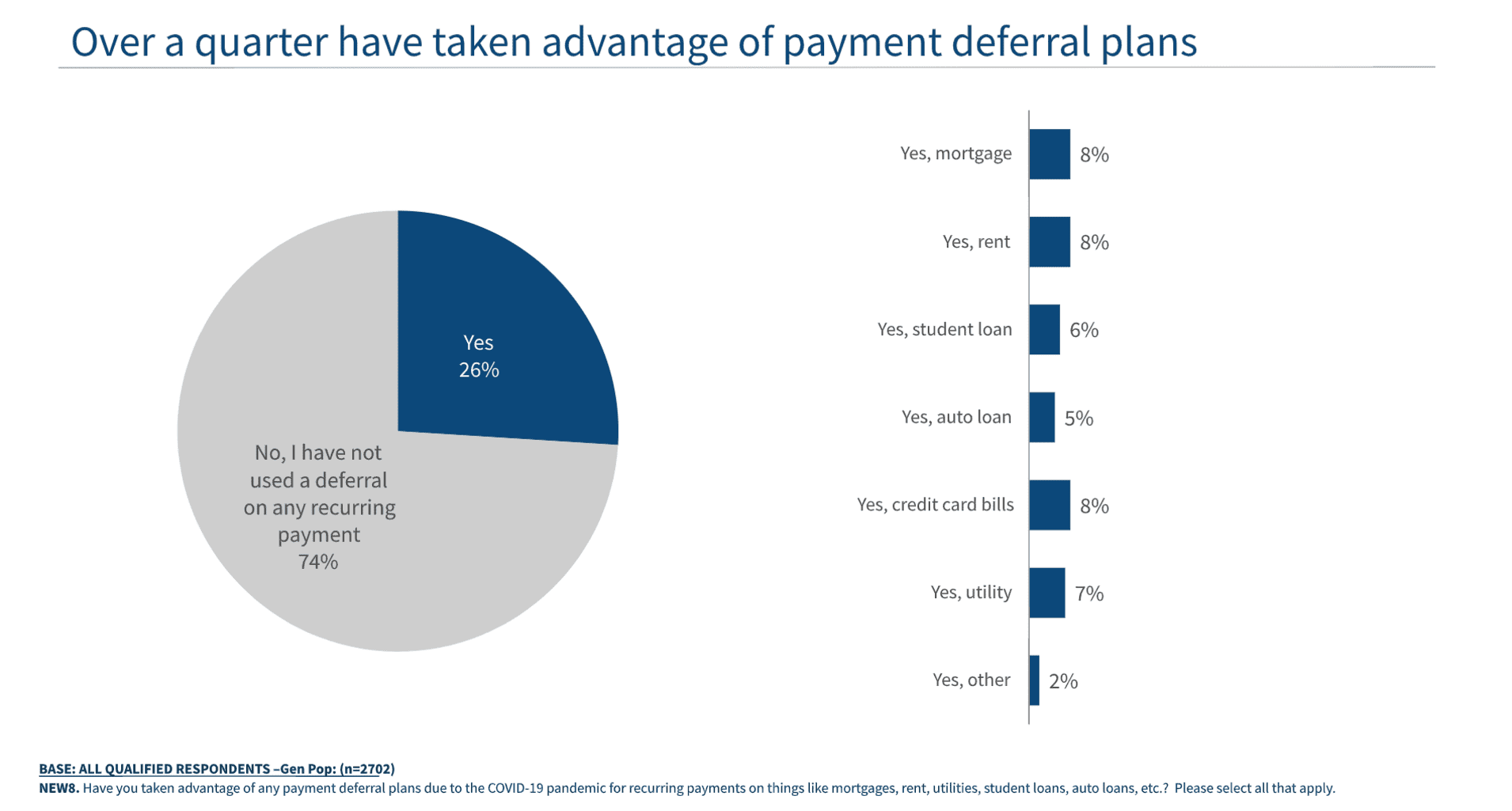

Read more on deferral plans on CNBC.com

Ok, so this is the less fun one- but also super important! Getting behind on credit card or car payment bills can decimate your credit score. Although most companies have happily given payment deferrals, that will be coming to an end soon (if it hasn't already) and that bill will be due! Use this money to get up to date and set your minimum payments on auto draft if you need to. Remember, payment history makes up 35% of your credit score. One 30/60/90 day late payment can stay on your report for 5–7 years, impacting the way you can leverage money and build wealth in the future. Make paying your bills on time a priority- your future self will thank you.

Pay down high interest debt

Got balances on those store credit cards charging you over 20%? Time to pay those down, because that interest rolls over and just keeps adding up. Example: on a $600 credit card bill with an interest rate of 20%, you can expect to pay $480 in interest if you stick to those minimum payments. Plus, it’s a great return on your investment!

Need a little help figuring out a debt paydown strategy? Let me know! There are many to choose from -another blog coming on that- but in the meantime I'm happy to help.

Support local businesses

There are a few things I don’t mind paying top dollar for: quality food, designer handbags, sustainable items, and local business. Now more than ever local business owners- particularly minority owned business owners need your help. So if you’ve got the previous 4 suggestions taken care of, set some funds aside to pick up something at your favorite local bookstore, coffee shop, restaurant, or gift shop.

From mckinsey.com

Treat yourself

Ok, here it is, it's what you've been waiting for! I said it. It’s OK to treat yourself! 2020 was a doozy and we all need a little time to decompress. Book a massage, take a day trip, or just take a day off work to relax. Spend time outside, exercise, experience something new, get some sleep, eat well- these are the actions that are scientifically proven to boost happiness, so I suggest starting there. Whatever you chose- savor it.

Start investing

Got your emergency fund and high interest debt paid? Sounds like it’s the perfect time to start your investment journey. Whether it’s increasing your 401k contributions (make sure you take advantage of any employer matching), starting a Roth IRA, a HSA or your individual investment account — investing early can take years off your working life! For example, $600 today becomes $2,796 in 20 years if you do nothing but put it into an index fund.

Not sure if you're ready to invest? Take the quiz!

Give to those who need more

Giving is one of my core values, and I hope it’s one of yours too — the world needs more of it. If you’re in a good place in life, consider donating to your favorite cause. Don’t have one? Now is a perfect time to do some light research and find something that speaks to your heart. These unprecedented times call for unprecedented generocity.

Image from Biz New Orleans

Whatever you end up doing with your recent stimulus check, I hope this blog finds you safe and well.