Think you're ready to invest?

Apr 07, 2021

Check these 6 items off your list first.

Don't want to read the article? Take this 2 minute quiz to figure out how ready you are to invest!

You’ve heard the hype. Bitcoin, Gamestop, the S&P500, rental homes, options trading, NFT (non-fungible tokens)- everyone’s talking about it.

What am I talking about? Investing!

I’m here to tell you that investing FOMO is real. Especially if you’re following financial accounts on Instagram or forced to listen to that rich uncle during the holidays. I hear you, you want to get in on the action. Why not now? Time is money, am I right?

Well, maybe. Yes, I encourage people to invest quickly because compound interest is powerful and time is the secret sauce of that power. However, it’s important to have the basics down first.

What should you be doing before you invest?

Let’s review the items you should have checked off your list before you open that brokerage account.

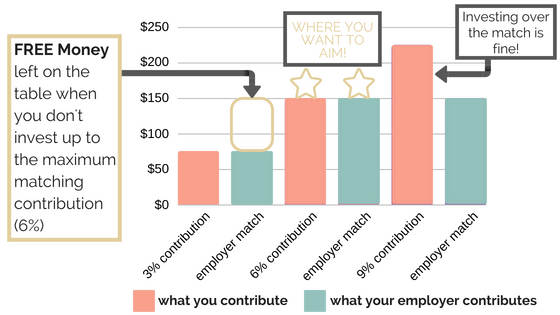

- If you have a 401k, and your employer gives you a match, contribute at least up to the match.

- Pay off all high interest debt

- Max out your retirement & other tax advantaged accounts

- Have an emergency fund

- Master living below your means

- Get a strategy and a positive mindset in place

Once you have these items checked off your list, you’ll be ready to blast off into the wide world of investing!

Before we deep dive into this checklist, let me clarify that this list IS in a particular order for a reason!

With that being said, there is NOTHING keeping you from working on 2–3 of these goals at a time.

Why do I mention goals here?

Well, turns out if you set these milestones as goals, you’ll be 10x more likely to accomplish them. Write down your goals and you’ll increase your chances on accomplishing these milestones by 20% (learn more here). Fun tip- you can use this for other areas of your work and life too!

I also wrote a blog all about goal setting! You can check that out here.

Read through below steps and then check out a real world client example for ideas of what your pre-investing goals could look like!

If you have a 401k, and your employer gives you a match, contribute at least up to the match.

Do you like free money? Yea, me too!

What is a 401k match? Typically it works like this: Your employer will match up to a certain percentage of the percentage you contribute to your own retirement.

Example: Mary’s salary is $60,000. Her employer offers a 4% match. So if she contributes at least $2,400 to her retirement, her employer will match her $2,400. If she were to not contribute to her retirement, she would be missing out on this money!

Furthermore, most 401k matches are built into your employment offer, so if you are not participating- instead of getting free money, you could be working for free- yikes!

What to do next: Investigate to see if your employer offers any 401k matching & make sure your funds are invested. Need a little guidance on what to then invest in, take a look at this tutorial. If so, contribute at least up to the match. If not, talk to your HR department and fellow co-workers to see if your employer would consider adding this into your benefit package!

Pay off all high interest debt

What’s considered high interest?

Well, it depends, but I would say 7% or higher. Why? The last 50 years on annualized stock returns (including adjustments for inflation) were 6.8%. So if you’re trying to decide whether or not to pay down debt or invest, this is a good tipping point.

I won’t wax on on debt pay down methods in this post, but see below for some of the pros and cons of 3 popular paydown methods.

What to do next: Be brave. List out all your debt accounts, the balances and the interest rates for each account. Next, identify all the accounts with an interest rate over 7% (or lower if you chose). Then pick a debt paydown strategy and stick with it. This can be where many people (myself included) have gotten stuck. Investing sounds so much more exciting than paying down debt, but I promise you that paying down your debts — and living a debt free life will open up so much more cash flow, and peace of mind for your future investor-self!

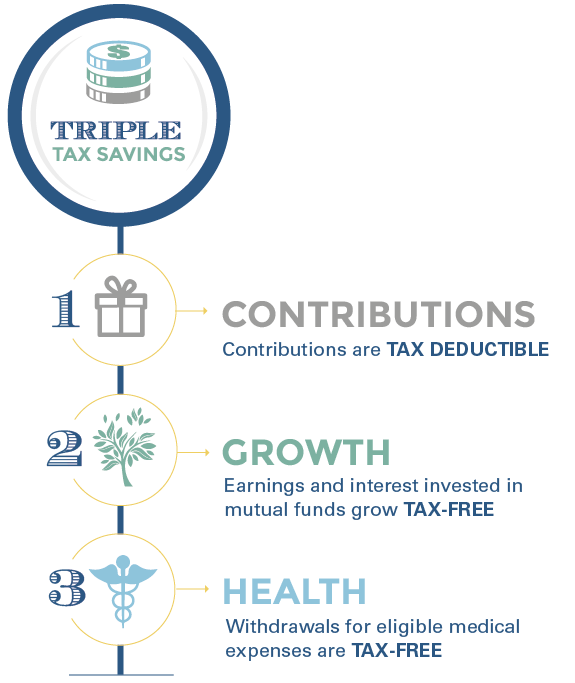

Max out your retirement & other tax advantaged accounts

In this item, you get to try on your investor hat- yay!

No matter what situation you find yourself in, there are ways for your to save up for your retirement and it’s important to check this off the list first. Why? Well, when it comes to retirement planning, time is your BFF.

You can check out a detailed list of available retirement options in another blog here for more detail. Note to self, don’t get stuck here. It’s not as exciting to start investing inside your retirement accounts and it can take time to max out those larger limits.

This feels like something we can’t brag over — but dont let that be a barrier to your success. Keep your eye on the prize. When you have the opportunity to retire much earlier than all your friends, you’ll be happy your started earlier and contributed as much as possible!

Example: If you contributed the maximum amount to your 401k, currently $19,500, it would only take you 22 years to reach $1M in your account, which many people feel is enough to retire on (I’ve seen it done with less)! This doesn't even include employer matching, contributing extra to a Roth IRA, or a HSA.

Speaking of which, if you’re eligible, look into a HSA. These offer a triple tax benefit and can super beneficial in your later years!

What to do next: Figure out what types of tax advantaged accounts you qualify for here. Figure out what your maximum contributions can be and automatically have them coming from your checking account or paycheck on a set schedule. Review the HSA requirements or check in with your HR department to see if this could be a good option for you.

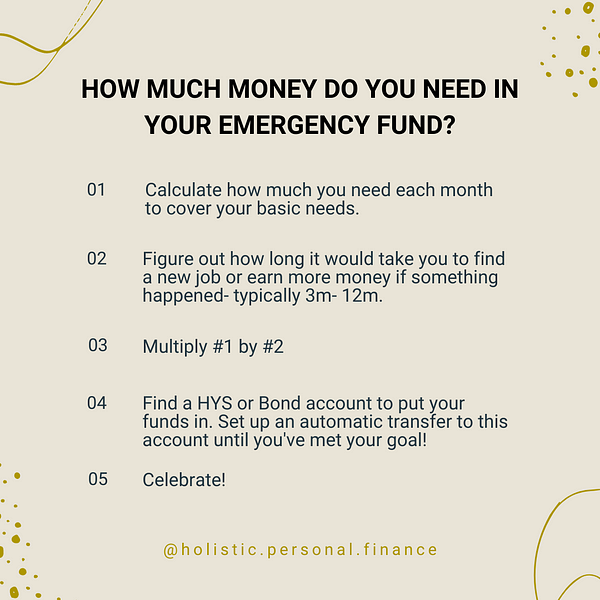

Have an emergency fund

If you follow me on Instagram, you know I give so much gratitude to my emergency fund. 2020 was a rough year for us all, and I took some particularly hard financial hits. If I didn't have an emergency fund, I could have easily gone into $15,000 of debt- putting me back at step 2. Instead, my emergency fund declined and I found myself back at this step instead!

An emergency fund allows for… well emergencies. So if something bad happens, and it might because- life, you’ll feel it as a financial speedbump instead of a New Orleans’ pothole on your financial journey. If you don’t get this analogy, click here.

What to do next: Use the steps provided to determine how much you need in your emergency fund, pick an account (usually a high yield savings or bond fund) and make regular contributions until you’re at your goal!

Master living below your means

If cash is King, then cashflow is The Queen!

Why? Because it’s really hard to build any wealth, or start investing without cash flow.

What is cash flow? Cash flow is simply the amount of money coming into your accounts minus the amount of money going out. Even if you’re making $500,00 each year, it can be difficult to build long term wealth if you’re spending $490,000.

Mastering your cash flow can look like:

- having a budget

- paying yourself first

- practicing intentional spending

- tracking your spending categories

- saving a set percentage of your paycheck

- using sinking funds

- and much more!

The point is, everyone’s system for managing the cash that comes in will be different.

What to do next: Calculate your current cash flow. You can start here. Figure out if there are any ways you can increase your cash flow by lowering your expenses or increasing your income. Take at least 3 months and try a few different ways to manage your cash flow and stick with the system that works best for you!

Get a strategy and a positive mindset in place

You made it! You checked off the ‘pre- investing’ checklist. Celebrate now!

After celebrating, take some time to prepare yourself for investing. What mindsets and strategies you’ll need to start investing will depend on your particular situation, but here are some items you’ll want to consider before jumping in.

- Risk- every investment involves a level of risk. Know your own risk tolerance and lower the risk of any investment by educating yourself.

- Fear- similar to risk, but fear of the unknown or losing can be a big mindset block that can keep you from earning more. Remember, money is meant to move and know that YOU are worth investing in!

- Options- what do you actually want to invest in? There are many options to suit many different styles. Real estate, investments, art, bitcoin, and businesses are just a small amount of examples. Consider the time and energy it might take to learn and maintain each type of investment.

- Strategy- use the skills you’ve been practicing in your retirement account , like asset allocation & diversification, and put it to work! Decide what percentage of your money would best serve your in different investments. As a general rule of thumb I would allocate only 10% of your portfolio to ‘high risk’ assets.

Getting ready to invest- what does this actually look like?

Ok, I promised you real world examples and here it is!

But first, let’s review quickly…. what should your goals look like?

There is a scientifically proven method to create & accomplish your goals and you’ve probably heard of it. It’s called the SMART method and it doesn't work for all aspects of life, but works perfectly for financial goal setting. Here’s a recap if you haven't seen it in awhile.

Now, let’s dive in with our example. We’re looking at Alice. Alice came to me and said ‘I’m ready to invest!’

So I naturally said, ‘woah Alice, let’s go through the checklist and see if you’re really ready.’

Alice's situation:

- Her employer doesn't offer a 401k or matching.

- She has $1,000 of high interest debt on a credit card.

- She doesn't contribute to an IRA or a HSA.

- She has a 6 month emergency fund.

- She makes a good income, spends in a frugal manner and has identified an extra $600 each month

- She wants to invest but has a lot of fear around losing all her money.

SMART goals we set for Alice:

- Gain support for an employee sponsored 401k + matching. Talk to 3 co-workers about the idea within the next month. If they agree, bring it up to HR within 1 week.

- Pay off high interest debt. Identified that 6 months of an emergency fund is overkill for her situation. Pay off the credit card debt using the savings within the next week.

- Start investing within a retirement account. Open a retirement account within 1 week. Utilize the $600 month identified as extra money to fund (automatically) for the next 10 months. Set up these auto contributions within 30 days.

- Start researching investments. Pick 2 investment options (real estate and stock market) and research them over the next 10 months to gain more confidence and create an investment plan.

- Increase her positive attitude around money. Identify 2 positive money mantras, write them down, and place them in a high traffic area within the next 2 week.

These are just some examples, but the great thing is — she can work on a few items on the checklist at. the. same. time. This gets Alice to her goals faster!

Another bonus, by the time she’s ready to start investing outside of her retirement she will already have practice investing and have a plan- so she’ll be fully prepared to hit the ground running.

Investing in assets is key to building wealth and it’s what rich people do best. To stay financially well, start with a master the basics first before you move onwards and upwards!