9 Tax Updates to Know Before You Tackle Your 2020 Return

Mar 17, 2021

Taxes! Taxes! Read all about it!

Doing My Own Taxes

I’ll be honest. I’ve been doing my own taxes for the last 15 years and have learned many lessons along the way. I *thankfully* have never had an audit, but have also never received any notices of mistakes or errors. I’ve switched this year, only because I started 2 businesses in 2020. One of best lessons I learned from working with rich people for years was….know when it’s time to get help. Stay tuned for an upcoming post on other lessons I learned from working with the wealthy.

I’ve done taxes for friends and family too. Doing taxes calls on my strengths of organization, attention to detail, and love of numbers and spreadsheets.

Do you have a different set of strengths? Don’t fret!

Should you file your own taxes?

If your tax situation is fairly simple, I encourage you to give it a go!

What constitutes simple? W-2'd income, no major list of deductions, no businesses or complex events that have happened within the year.

If you have a more complex situation, then I’d advise you to do your research and find a CPA that you trust and feel comfortable with.

How do Taxes Work?

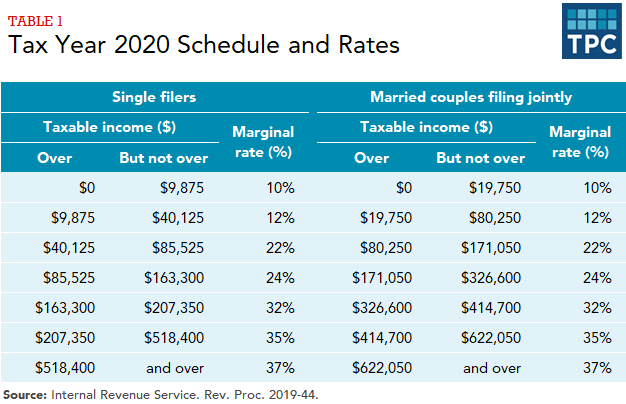

Let’s do a brief review of how taxes work. We’re going to focus on Federal taxes here, since State taxes vary greatly. The Federal tax system is progressive — this means that as you make more the higher portions of your income will be taxed more. See a great illustration below from the Tax Policy Center. You can think of your income being taxed in different buckets or brackets. It’s important to have an idea of where your taxable income lies in the bracket system.

For example, if you are single and your taxable income is $86,000 you might be more motivated to try and use deductions to lower your taxable income to under $85,525 to save $114 on your tax bill.

Most people don’t take into account that their taxes are a (somewhat) negotiable BILL. Yes, just like your housing payment. Not only that, but your taxes may be your biggest bill. So, take control today by learning more about how you can lower your 2020 tax bill.

What You Should Know for 2020?

What a year, am I right?

Needless to say every person has been financially affected by 2020. Whether you lost your job, collected unemployment, received a stimulus, earned more (if you were in a WFH industry), moved, saved more, or had increased healthcare costs.

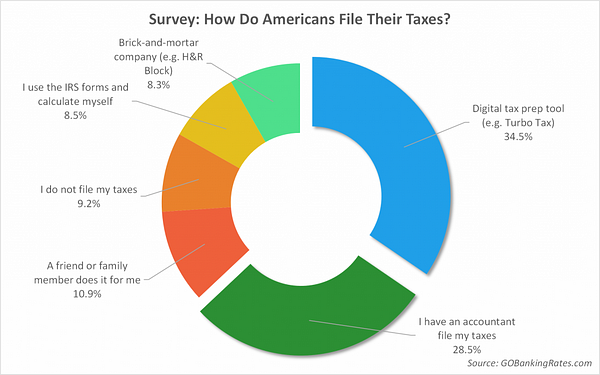

So, instead of focusing this blog on everyday information, I want to provide some useful tidbits that you can put into practice this year whether you’re part of the 35% filing yourself or using a trusted CPA.

Here we go!

1. As of right now (3/1/21) there is no automatic extension like there was last year.

So the due date to file is April 15th! If you miss the date or don’t file an extension in time you’ll pay a penalty of 5% of your owed taxes. The penalty starts April 16th and can grow to 25% of your taxes owed the longer you wait to file and pay.

2. Unemployment benefits are TAXABLE.

If you collected state unemployment or the extra $600 of unemployment benefits then look for your 1099-G form. You’ll need to disclose this income and file this form with your return. Note that unemployment is tax-exempt for some states.

3. Stimulus Payments are TAX FREE.

This might be the best thing you’ve read all day!

4. If you didn’t receive a stimulus or the full stimulus, you could still qualify for more money.

This could be the 2nd best thing you’ve read all day. You’ll need to collect your AGI for 2019 — so dig up that 2019 tax return. You’ll also need to log in the amount of stimulus money you did receive (for both payments). Depending on how your 2020 tax returns shake out, the IRS could reimburse you more of the stimulus in the form of a credit to your taxes. Learn more about this new process HERE.

5. If your business received money from the PPP loan (Paycheck Protection Program) this money is also tax-free.

Also, you still can deduct the business expenses you paid for with your loan money — awesome, right! You can apply for new PPP money in 2021, where more funds are being directed towards small businesses, like under 100 employees small. Learn more about that HERE.

6. The standard deduction has increased.

The standard deduction typically increases each year due to inflation. For 2020, the standard deduction rose to $12,400 for individuals ($24,800 for married couples filing jointly). Taxpayers age 65 or older are eligible for an even higher standard deduction, $14,050 for individuals and $27,400 for married couples filing jointly. Now, take a look at your deductions (see a list of common deductions below), if your deductions exceed the standard deduction for your filing status, consider itemizing on your return. Need a little more information on itemizing, check out this article from Nerdwallet.com.

7. Even if you take the standard deduction, you can still deduct up to $300 of charitable donations.

Did you go to any charity events last year? Yeah me either. Turns out a small provision thrown into the 2020 CARES act to help encourage people to donate to local nonprofits who suffered greatly with the pandemic. If you do itemize, you get some bonuses too. You can now deduct contributions up to 100% of your adjusted gross income (AGI). This used to be 60%. In addition, these updates will be carrying over to 2021.

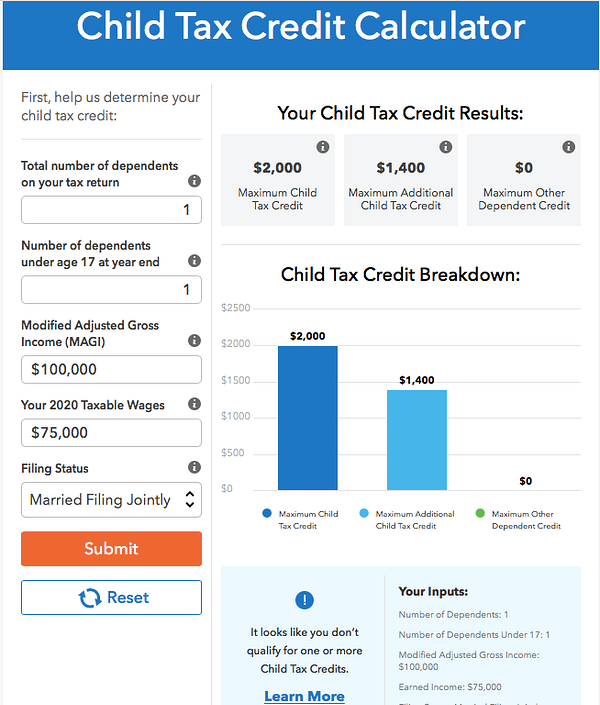

8. Take a good look at the Child Tax Credit.

There are 7 requirements that both you and your child will need to check off. The requirements are:

- Age: a child must have been under age 17 at the end of the tax year for which you claim the credit.

- Relationship: the child must be your own child, a stepchild, or a foster child placed with you by a court or authorized agency.

- Support: the child cannot have provided more than half of his or her own financial support during the tax year.

- Dependent status: you must claim the child as a dependent on your tax return.

- Citizenship: the child must be a U.S. citizen, a U.S. national or a U.S. resident alien.

- Length of residency: The child must have lived with you for more than half of the tax year for which you claim the credit. There are a few exceptions that you’ll want to check into.

- Family income: beginning in 2018, the phaseout of the credit begins with $200,000 in income ($400,000 for married filing jointly).

For more information you can check out this awesome calculator from TurboTax.

9. The threshold for deducting medical expenses has been lowered- permanently.

Is this the 3rd best thing you’ve read all day or what? We’re on a roll! Previously the medical deduction threshold was 10% of AGI. So, if you’re AGI was $80,000, you would have had to spent $8,000 on medical expenses to utilize this expense as a deduction. Woah! The TCJA (Tax Cuts and Jobs Act) and recent legislation (Taxpayer Certainty and Disaster Tax Relief Act of 2019) has lowered this to 7.5%. So in our previous example, you would have to spend only $6,000. Pretty big difference!

There it is, all the major tax updates you need to know about before filing this year. Is all this too much to absorb in the next few weeks? Good news! Anyone can file an extension with Free File. Extensions will give you until October 15, 2021 to file, but keep in mind if you owe money this year, it’s still due on April 15th.

Taxes may be one of the least exciting areas of personal finance. Trust me, it’s much more fund to talk about investments, compound interest, or ways to save or make lots of money! So, if you’ve made it to the end of this blog- I commend you. Overall, I think we’ve all got some great opportunities here- but you can’t take advantage of them if you don’t know about them. So, I hope you feel encouraged to do your research and lower that tax bill!